The Power of Leverage: Three Reasons to Use Assets as Collateral

“Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.”

– Archimedes

In a previous blog we asked if your assets passed the leverage test. And perhaps you wondered to yourself, “But why would I WANT to leverage my assets or use them as collateral? Don’t I want them to be “free and clear”?

The Myth of “Free and Clear”

The myth of “free and clear” is that if you are debt-free, you are maximizing your money by avoiding paying interest. But is that how the wealthy of the world operate!? Consider the following…

- Do wildly successful business people typically start companies in which they refuse to seek capital in the form of business loans or stock, content to grow them slowly without the help of ANY outside dollars?

- Do people become successful real estate investors by saving up money to buy each rental house “free and clear”?

- Do the rich of the world keep their money in a liquid/cash state so they have access to all of their money if necessary, or do they put their money to work, generating new wealth?

The wealthy borrow against – or leverage – their own assets as a standard rule of practice. They do it wisely and cautiously, but with an appreciation for how leverage can multiply their profits and allow them to control more assets than simply their cash.

The Power of Leveraging Your Assets

Leverage helps increase the VELOCITY or “movement” of dollars through your asset. It also helps your dollars do more than one job, and when you multiply the JOBS your dollars do, you’re using strategies that tend to multiply your DOLLARS as well.

Here are three reasons you may WANT to leverage your assets to increase the velocity of your dollars.

1. The ability to leverage or use assets as collateral gives you financial flexibility.

Without financial flexibility, many investors tend to divide up their money in ways that make it inefficient, inaccessible, or both. They try to fund an emergency account, a 401(k), an IRA, an HSA, a 529, plus disability, life, and long-term insurance, perhaps even pay off a credit card to boot. The result? They end up with “too many accounts with not enough money,” as we discussed in our article on “Financial Flexibility.”

Having ample savings gives you safety, security, and the ability to respond to opportunities as well as emergencies. But who can afford to have 6, 9, or 12 months of living expenses parked in a savings account earning next-to-nothing?

Having savings or assets that you can easily leverage if needed means that you won’t have to repeatedly deplete your savings account – or worse, your credit limit – when you need cash. Instead, you can keep your assets working for you, and use them to provide your own financing for that new vehicle, rental property down payment, or college tuition.

2. Leverage can increase cash flow.

The ability to leverage assets can make an investment opportunity possible, or it can even make a good investment better. As Truth Concepts software’s Todd Langford explains in this real estate calculator tutorial based on a real-life example, leveraging the cash value in a life insurance policy might make a lot of sense when acquiring a cash-flowing rental property, provided that the cash flow is adequate.

Of course, another commonly leveraged asset is real estate itself. And while the mantra taught by many financial gurus is to “pay off your mortgage as soon as possible,” we can see from the following hypothetical example (compliments of Kate Phillips of Total Wealth Coaching and calculators from Truth Concepts software) how paying off your mortgage can actually slow wealth-building down. If your goal is growth and cash-flow, it may make sense to leverage. Let’s see how a mortgage might affect investment real estate from a wealth-building perspective:

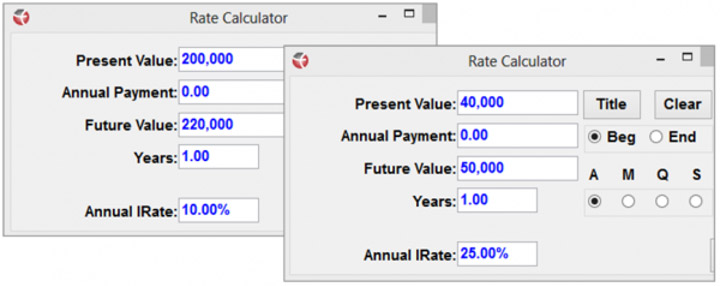

Example 1: You have $20k cash flow each year (after taxes, insurance, and maintenance) on a property that you own outright. The property is worth $200,000, and your $20k cash represents a 10% annual rate of return on that asset.

Example 2: You bought the same $200k property with 20% down ($40k), borrowed the other 80% ($160k). and earned only $10k cash flow per year due to the mortgage payment.

Your cash flow is half of the first scenario, in which you own the real estate outright, but your ROI is actually much higher with the mortgage. Why is that? Because now you are earning $10k with only $40k of your own money invested. The other $160k comes from the mortgage. Earning $10k on your $40k investment represents a 25% annual return!

3. Leverage can expand your total assets.

Let’s take this hypothetical example further. If your intention is to invest $200k into real estate, you could buy one property, as our first example above. But let’s suppose you could buy 5 similar cash-flowing properties with 20% down, or $40k each, you would now have 5 properties earning $10k per year, or a total of $50k.

Your rate of return would still be 25%, as in our second example above, but instead of controlling one $200k asset, you’d be controlling FIVE $200k assets, or one million dollars in assets – with the same $200k investment!

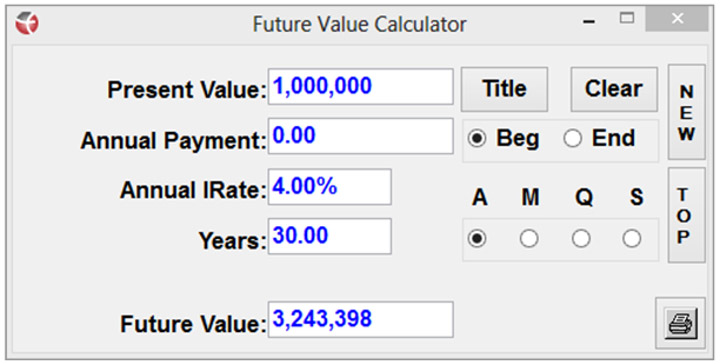

Yes, you’d also have five times the work, if you were managing the properties yourself! But you would have five times the cash flow as well. And at the end of 30 years (supposing a 30-year mortgage), you’d own five houses free and clear. And at a modest appreciation rate of 4% over 30 years, those five homes could now be worth more than 3.2 million dollars!

Contrast that to simply owning ONE house free and clear at the end of 30 years (worth less than $650,000), or even investing the whole $200k in account growing at 7% (totaling just over $1.5 million – without taxation OR 30 years of cash flow), and you can start to really understand the power of leverage.

The ability to leverage is the reason studies consistently show a shocking difference between the net worth of homeowners and renters. Even when home prices were still recovering in 2010, according to a Consumer Finances report published by the Federal Reserve in 2012, the average total financial assets of renters totaled only $12,600 vs. $296,200 for homeowners, a differential of more than 2,300%!

Like the chicken vs. the egg, one might argue which came first – home ownership or a certain level of wealth, but an analysis of various categories proves to be compelling. There was a larger gap in net worth between homeowners and renters than between those of different education levels, locations, race, even types of occupation. The only factor that appeared to be equally or more powerful than homeownership in terms of growing wealth, statistically-speaking, was age.

Caution: A Warning about Over-Leveraging Assets

Just as leverage can make a good investment better, be aware that it makes a bad investment worse! If you did own five rental properties, you would want plenty of access to cash for occasional big-ticket items such as a new roof or tenants-gone-wild.

Even with a well-maintained rental, if you over-leverage real estate so that it no longer cash flows (perhaps counting on appreciation to make it a good investment), you may find that you have an unsustainable or even worthless investment if the winds change. In 2008-2009 when the real estate market took a sudden downturn, many foreclosures resulted from such speculation.

Similarly, if you under-capitalize a business or leverage against your stocks to purchase more stocks and there is a severe decline, you will magnify your losses, potentially even losing more than you started with.

However, just because leveraging your assets must be done carefully doesn’t mean that it shouldn’t be done! (That would be like saying we shouldn’t use furnaces, heaters, or wood-burning stoves because they can burn down a house.) No, we must exercise caution by paying attention to cash flow and not speculating on returns.

Should You Consider Using Your Assets as Collateral?

Borrowing against your assets, whether a home, a business, a life insurance policy or any other asset should be done with care. The wealthy put their dollars to work, and they also tend to maintain positions of relative liquidity that they can tap into as needed for major purchases, emergencies, and new investment opportunities generating reliable returns.

The bottom line is clear for those with ears to hear: leverage is a simple yet powerful strategy that you neglect at the peril of your own wealth.

Originally posted by Prosperity Economics Movement in May 2014. Reposted here with permission

Popular posts